The Greatest Guide To Home Owners Insurance In Toccoa Ga

Table of ContentsWhat Does Medicare Medicaid In Toccoa Ga Do?Not known Details About Final Expense In Toccoa Ga Getting My Life Insurance In Toccoa Ga To WorkAn Unbiased View of Commercial Insurance In Toccoa Ga

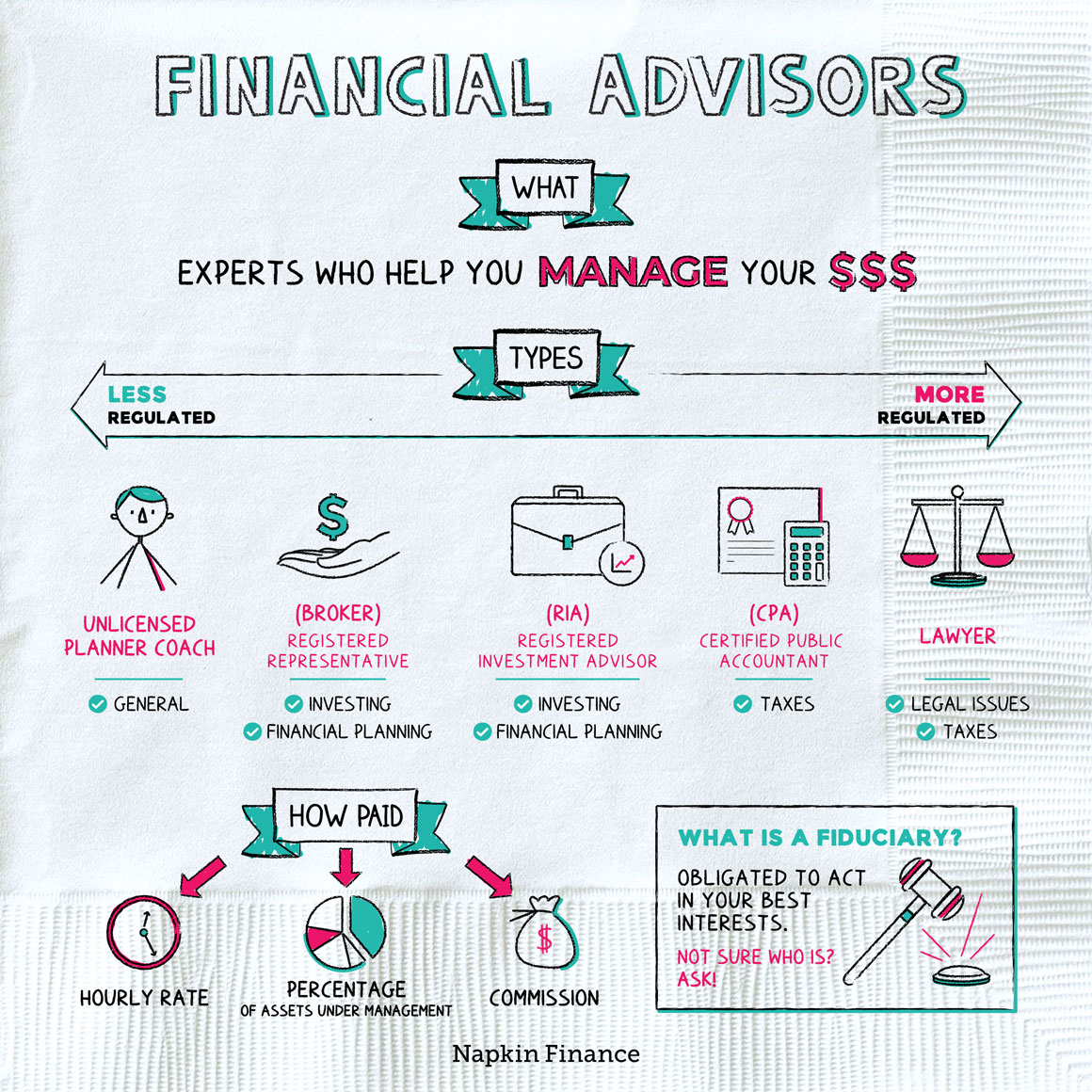

A financial expert can likewise assist you determine how finest to achieve objectives like conserving for your child's college education or settling your financial debt. Although monetary consultants are not as well-versed in tax legislation as an accountant may be, they can provide some support in the tax planning procedure.Some economic experts use estate planning services to their customers. They could be educated in estate preparation, or they might intend to deal with your estate attorney to address inquiries about life insurance policy, trusts and what must be done with your financial investments after you pass away. Finally, it is necessary for monetary advisors to keep up to day with the marketplace, economic conditions and consultatory ideal techniques.

To market financial investment products, experts should pass the relevant Financial Industry Regulatory Authority-administered exams such as the SIE or Series 6 tests to get their accreditation. Advisors that wish to market annuities or various other insurance items must have a state insurance coverage license in the state in which they intend to sell them.

The Greatest Guide To Affordable Care Act Aca In Toccoa Ga

Allow's state you have $5 million in possessions to handle. You employ an advisor that bills you 0. 50% of AUM each year to help you. This means that the expert will get $25,000 a year in charges for handling your financial investments. Because of the typical cost framework, lots of advisors will not function with clients that have under $1 million in possessions to be managed.

Financiers with smaller sized profiles could look for an economic expert that charges a hourly fee rather than a percentage of AUM. Per hour costs for experts usually run in between $200 and $400 an hour. The more complicated your monetary situation is, the more time your advisor will certainly need to dedicate to managing your possessions, making it much more costly.

Advisors are knowledgeable specialists who can help you develop a prepare for economic success and execute it. You might also consider connecting to an expert if your personal financial circumstances have actually lately come to be much more complex. This could suggest acquiring a home, getting wedded, having kids or receiving a huge inheritance.

The Buzz on Insurance In Toccoa Ga

Prior to you consult with the consultant for a preliminary consultation, consider what solutions are essential to you. Older grownups may require help with retired life preparation, while more youthful adults (Final Expense in Toccoa, GA) may be searching for the most effective means to invest an inheritance or starting a service. You'll desire to seek a consultant who has experience with the solutions you want.

What organization were you in before you obtained right into monetary suggesting? Will I be working with you straight or with an associate advisor? You may additionally want to look at some sample monetary strategies from the advisor.

If all the samples you're supplied are the same or similar, it might be a sign that this advisor does not appropriately customize their recommendations for helpful hints each and every client. There are three primary kinds of monetary encouraging professionals: Certified Monetary Coordinator specialists, Chartered Financial Analysts and Personal Financial Specialists - https://www.youmagine.com/jstinsurance1/designs. The Licensed Financial Coordinator expert (CFP expert) accreditation suggests that an advisor has met a professional and ethical standard set by the CFP Board

9 Easy Facts About Health Insurance In Toccoa Ga Shown

When choosing a monetary consultant, consider somebody with a specialist credential like a CFP or CFA - https://yoomark.com/content/thomas-insurance-advisors-located-toccoa-ga-and-toccoas-leading-insurance-agency-serving. You could additionally consider an advisor that has experience in the solutions that are most important to you

These advisors are generally filled with disputes of interest they're extra salesmen than advisors. That's why it's crucial that you have an advisor that functions just in your benefit. If you're seeking an expert that can genuinely give actual value to you, it is essential to investigate a number of possible options, not merely pick the initial name that advertises to you.

Currently, many advisors have to act in your "finest passion," but what that entails can be nearly void, other than in the most egregious cases. You'll need to discover an actual fiduciary.

"They need to confirm it to you by revealing they have actually taken severe recurring training in retired life tax obligation and estate planning," he states. "You ought to not invest with any consultant that doesn't invest in their education and learning.